New Hurdles to Foreign Buys

The RBI’s recent moves restrict the expansion plans of Indian multinationals and the M&As of Indian entities abroad.

Over the past decade, through overseas acquisitions and investments Indian multinationals have been able to access technology and intellectual property, establish international consumer bases, and carve out a slice of the global market pie. Such outbound investments are important for their long-term growth and, perhaps, for the general economy. They would have not been possible without the impetus provided by the Government through economic reforms and liberalisation.

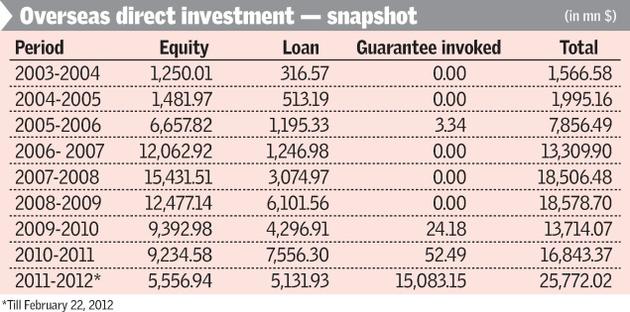

In March 2003, the Government revised the ‘automatic route’ for overseas investment, allowing Indian corporates to invest up to 100 per cent of their net worth abroad without government approval. From September 2007, they could invest up to 400 per cent of their net worth and overseas investment increased significantly. Although the trend was moderately affected during the crisis year 2009–10, there was a sharp rebound in 2010–11.

However, the Reserve Bank of India recently reduced the net worth limit for overseas direct investment by resident entities (other than oil public sector undertakings) from 400 per cent to 100 per cent. This measure, together with the reduction in remittances under the Liberalised Remittance Scheme from $200,000 to $75,000 appears to be aimed at arresting the rupee’s decline by curbing foreign exchange outflow.

This will surely restrict the expansion plans of Indian multinationals and the M&As of Indian entities abroad. It could also adversely impact sourcing of foreign capital for Indian investors. Indian entities often use the leverage buyout route to fund acquisitions abroad to reduce the risk on the domestic balance sheet. The funding is often arranged through overseas banks, and backed by guarantees from the Indian parent.

Given that a portion of the guarantees is included in the overall ‘net worth’ limit, even sourcing of foreign money could pose challenges.

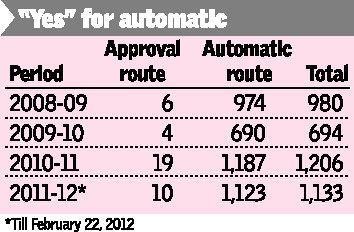

While the RBI has suggested that a corporate could always seek approval when it needs more money to acquire an asset abroad, and when the investment exceeds the limit, it is seen that the number of proposals under the approval route is negligible compared with that under the automatic route. It appears that the rationalisation measures are aimed at easing pressure on the rupee, rather than capital control.

However, Government policies should necessarily consider the larger, long-term impact on business, and avoid knee-jerk reactions.

Indian multinationals desirous of growing their global footprint are hoping that the measure is for the short term, and that the Government will realise the need for a rollback.

Vaibhav Luthra, senior tax professional contributed to the article.

The author is Associate Director — Tax & Regulatory Services, EY

Via : thehindubusinessline.com

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply