Rural India Buys Brands

From a sleepy town five years ago, Rudrapur in Uttarakhand today is active and vibrant, thanks to the state government’s efforts to promote industrial development. Other small towns such as Ahmednagar (Maharashtra), Vapi (Gujarat), among others juxtaposed between urban cities and villages, are changing today and are said to hold the key to India’s economic future.

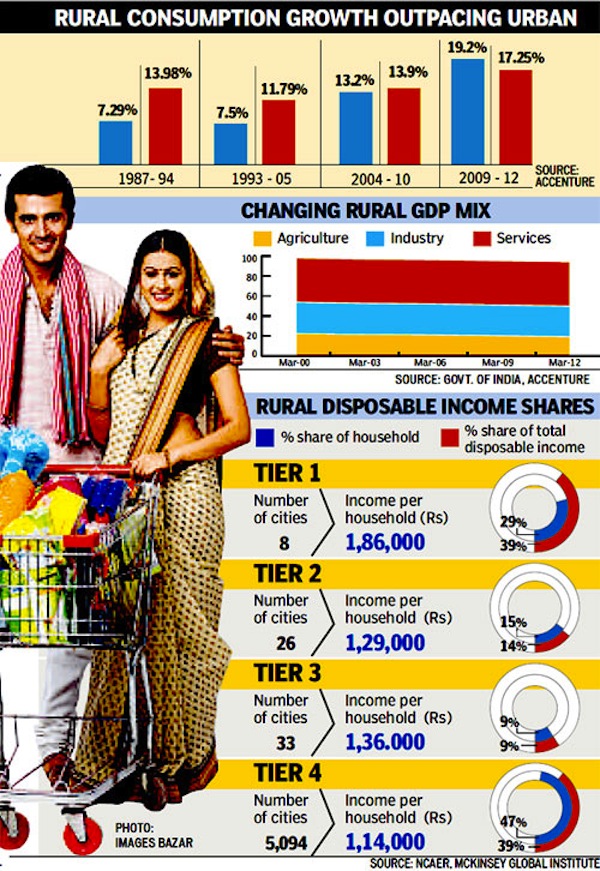

No wonder that 67% of companies in India are expanding their presence in these tier IV and beyond markets, says a study by Accenture, ‘Masters of Rural Markets: Profitably Selling to India’s Rural Consumers’. Since 2000, GDP has grown faster in rural India than in urban: at a 6.2% compounded annual growth rate versus 4.7%. Between 2010 and 2012, spending in rural India was Rs. 3,73,566 crore, while urban consumers spent Rs. 2,97,770 crore.

“More companies are expanding their base in India’s rural markets, and for good reason. The business environment is improving, thanks to better infrastructure and the growing number of consumers who are earning more and snapping up products and services that support their aspirations,” said Sanjay Dawar, MD – management consulting, Accenture India, in the report.

“Tier IV is no longer a poverty market as small towns are catching up with urban centres in terms of disposable incomes and consumption,” said Kirti Prasanna Mishra, partner at rural market research firm MART. “There has been exponential growth in the quantum of consumption in the small towns. Places such as Rudrapur alone have seen a 10-fold growth in retail, education and healthcare.”

A few reasons are driving the growth of brands in rural India: a highly penetrated urban market, requiring fresh markets to be tapped; a young, more aspirational majority population; improved education; higher disposable incomes; and more employment and economic initiatives by the government.

A Roland Berger Strategy Consultants (RBSC) report, ‘How to reach emerging market consumers with new strategies’ says: “Emerging markets will be extremely young in terms of demographics. In 2030, 40% of the population will be under 25, compared to just 26% in developed nations. This fact will have a profound influence on consumption patterns.”

According to a Tata Strategic Management Group report, one-third of fast moving consumer goods (FMCG) and consumer durables are sold in rural markets.

A McKinsey Global Institute report says that by 2025, annual real income per household in rural India will grow from the 2.8% of the past two decades to 3.6% over the next two decades.

While companies are tapping consumers through the 45,000 haats across rural India, they are also beginning to introduce more suitable products and pricing. Many brands have revised unit prices downwards. Procter & Gamble has made Whisper available at Rs. 25 for a pack of eight sanitary napkins. Whisper is the market leader in rural India too.

Hindustan Unilever has been training rural women as Shakti Ammas to reach its products to consumer homes – the last mile. Reportedly, the Shakti initiative delivers around 20% of Unilever’s overall rural sales.

Godrej Consumer Products trains rural youth in channel sales. ITC has Choupal Sagar and Godrej Agrovet has large format retail stores called Adhaar.

According to industry estimates, rural India buys 45% of all branded soft drinks and 49% of all motorcycles sold in India. The Accenture report states that between 2009 and 2012, annual rural per capita consumption grew at 19%, which was 2% higher than the urban consumption. It quotes a Nielsen estimate that says the FMCG market in rural India will hit Rs. 5,48,000 crore (US$ 100 billion) by 2025, up from the current Rs. 65,844 crore (US$ 12 billion).

Via : hindustantimes.com

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply