Why India's Corporate Bigwigs Want to be Bankers

From Tata, Birla and Ambani to ambitious financial services entrepreneurs, everyone sees money in a banking licence. But cut to the core, and what you find is a clear play on the India growth story, and not much else.

Image: Ambani: Sameer Joshi / Fotocorp; Kampani: Ganesh Lad / Fotocorp; Thyagarajan: R A Chandroo / MINT; Radhakrishnan: Jyothy Karat for Forbes India; Bajaj: Getty Images; Lall: Amit Verma; Mistry: Vivek Prakash / Reuters; Jain: Vikas Khot; Birla: Dinesh Krishnan

Everyone, from the mighty whales to the financial minnows of India Inc, would like to be a banker. Whether it is the pull effect of a new opportunity that beckons, or the push effect of an existing business model that is going nowhere, or a mix of both, India is awash with entrepreneurs who seem to think that a banking licence is a licence to print money. On June 30, when the Reserve Bank of India (RBI) officially closed its window for applicants, there were 26 in the queue, including the government’s own India Post.

Serving as a beacon for all comers is one outlier: HDFC Bank. On July 17, HDFC Bank reported a 30 percent growth in net profits for the April-June quarter. Nothing odd, it would seem, till you note that it is the 55th consecutive quarter in which it has managed to show that kind of growth. No bank, private or public, has ever managed to equal that feat. Given the consistency of its profit numbers, market analysts have given the bank one of the highest stock market valuations in the world—currently at over five times book value (as on July 15). Its return on assets for 2013-14 is estimated by Espirito Santo Securities (ESS) at 1.87 percent. Put differently, nearly Rs 2 out of every Rs 100 lent by the bank is profit.

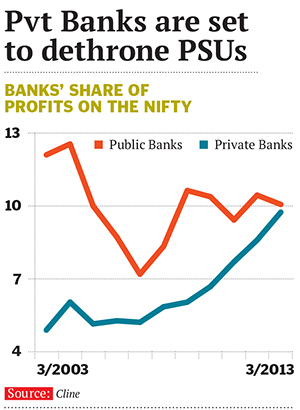

If HDFC Bank is the beacon that tells every aspirant that there’s money in them thar banks, the story is not restricted to one bank. As a group, the major private sector banks have been reporting significantly higher returns on assets (ranging from 1.5 percent to 1.87 percent of assets, against less than 1 percent by and large for public sector banks) and forward price-earnings multiples that are twice or thrice as high as that of public sector banks.

The secret of HDFC Bank’s success, as executive director Paresh Sukhthankar told Forbes India, is that the bank has focussed on balancing three critical variables: Growth, margins and asset quality. “The bank has consciously opted to grow in a manner which balances its growth with stable margins and acceptable asset quality.” Regardless of whether the interest rate cycle is up or down, HDFC Bank’s net interest margins are stable.

In short, if you’re smart, banking is among the best businesses to be in. There’s an outlier to target, and there’s the sloppy public sector to snatch business away from.

The paradox this time around is this: Banking appears to be both the best and worst business to be in. The world over, banks have had a few rough years after the 2008 Lehman bust. In the US and Europe, public trust in them has dwindled, while in emerging economies, including India, the slowdown has impacted profits. The sticky loans of Indian banks have been rising as even big businesses struggle to remain standing in an economy that seems to have entered a period of stagflation.

And yet, market opportunities have increased, quality banking is still lacking in many areas and expansion and proliferation is not well laid out, according to H Srikrishnan, who helped set up HDFC Bank in the mid-nineties and Yes Bank a decade later. “The trick for the new players will be to identify and fill the gaps in the market with innovative products,” says Srikrishnan, who has now joined the board of Religare Enterprises, one of the new aspirants.

“The sector is inherently attractive. There are very few businesses where top line has grown at 18 percent and bottom line at 22 percent for an extended period,” says the spokesperson for one of the big corporate hopefuls.

“The sector is inherently attractive. There are very few businesses where top line has grown at 18 percent and bottom line at 22 percent for an extended period,” says the spokesperson for one of the big corporate hopefuls.

But will the entry of new players change the nature of returns? One of the best ways to look at this sector is by comparing the earnings yield on the NSE banking index with 10-year government bond yields. Banking is one of the few sectors where the earnings yield (which can also be called the yield on equity) has been higher than bond yields for more than 52 percent of the time, indicating that the sector was a buy for much of the past 10 years. But things are changing now. The Bank Index’s earnings yield is now slightly lower at 7.22 percent than bond yields at 7.32 percent.

It’s possible the new banking hopefuls are looking more at the promise of the sector than the immediate profitability. Apart from the usual suspects—Tata, Birla and Ambani—the surprise names in the list of hopefuls were a whole host of players from broking, microfinance, non-bank finance companies, money remitters and infrastructure lenders, among others. Past experience suggests that few make the final cut. Fewer survive.

Of the nine players given banking licences in 1993-94 and two more in the early 2000s, four are gone: Global Trust Bank failed; and three others, Centurion Bank, Bank of Punjab, and Timesbank got digested when they gave up the fight for scale in the business. The last three were swallowed, one chomp at a time, by—who else—HDFC Bank. Only two banks—Kotak Mahindra, which converted from an NBFC, and Yes Bank, floated by professional bankers—were allowed in the next round in the mid-2000s. Both have found lucrative niches and are flourishing.

Read more: forbesindia.com/article/the-new-bankers

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply