51% FDI in multi-brand retail likely to include FIIs

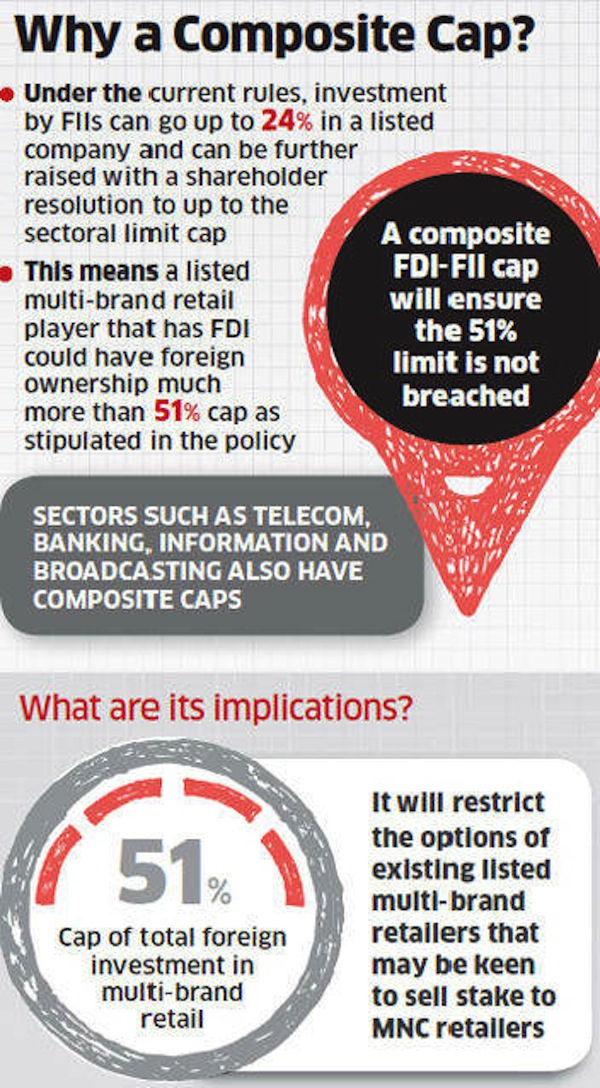

The 51% foreign direct investment in multi-brand retail is likely to include foreign portfolio investment as well, as the government is keen to ensure that the restriction on foreign ownership is not breached.

The government is wary that any breach in the limit will give more fodder to those opposed to opening of the sector to foreign investors, a hard fought reform for the UPA government that lost some key allies on the issue.

“There will be a composite 51% cap for both FDI and FII investment in multi-brand retail,” a government official privy to the development told ET.

The composite cap could restrict the options of existing listed multi-brand retailers that may be keen to sell stake to multinational stores.

Under the current rules, investment by foreign institutional investors can go up to 24% in a listed company and can be further raised with a shareholder resolution to up to the sectoral limit cap.

This implies that a listed multi-brand retail player that has FDI could have foreign ownership much more than 51% cap as stipulated in the policy, a situation the government is keen to avoid.

Sectors such as telecom, banking, information and broadcasting also have composite caps wherein the cap is applicable on all forms of foreign investment and not just FDI.

The policy on multi-brand retail mentions 51% cap on FDI but the view across the stakeholder ministries is that the intent was to allow foreign investment upto that limit. The government is concerned about the sensitivities attached to the sector and wants to tread with caution. Only 11 states have allowed FDI in the sector.

However, foreign institutional investors ( FIIs) investors will not face the sector conditions imposed on foreign retailers that invest in India.

Foreign retailers that want to set up retail stores in India have to mandatorily invest at least 50% of the total FDI brought in has to be invested in ‘backend infrastructure’ within three years of the first tranche of FDI wherein back-end infrastructure includes capital expenditure on agriculture market produce infrastructure and others. At least $100 million FDI has to be brought in by the foreign investors.

Foreign retailers also have to adhere to minimum sourcing requirement from small and medium enterprises.

Moreover, any entity with FDI can only set up shop only in those states that have allowed FDI in retail.

India had opened the sector in September 2012 but is yet to see any FDI in the sector.

Via : ET

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply