Real Estate Boom! Is Osama Responsible?

Real Estate Boom! This is not an irrelevant term in the Real Estate industry. Every broker/realtor loves to hear these words and consequently every investor and businessman in the country starts rolling his hands in glee at the prospect of a handsome profit. Sorry to burst your bubble, but that’s not what we’re talking about here.

Real Estate Boom! This is not an irrelevant term in the Real Estate industry. Every broker/realtor loves to hear these words and consequently every investor and businessman in the country starts rolling his hands in glee at the prospect of a handsome profit. Sorry to burst your bubble, but that’s not what we’re talking about here.

News Flash!

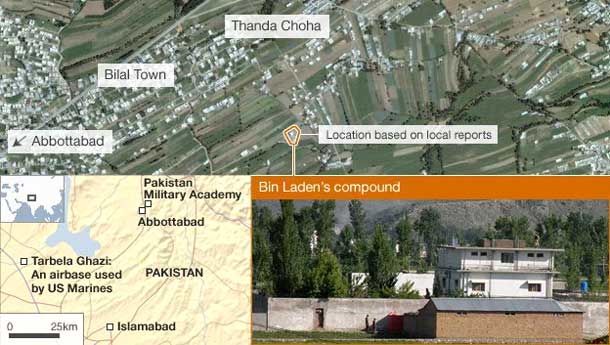

The recent covert operation by the US in Pakistan to nab and exterminate Osama Bin Laden was the culmination of a decade long hunt and the result of which is a cry of relief amongst people worldwide who have been directly or indirectly victims of the War on Terror. On a lighter note, have you ever wondered what will happen to the Real Estate of that little town miles away from the capital? An IT consultant who had left the hustle bustle of the city to live in Abbotabad and was inadvertently live tweeting about the raid as it happened, is now aware that his little getaway will not be the sleepy town it once was. So will real estate prices in that town shoot up or is it just an silly guess? The truth of the matter is that market forces that govern trends are not always the same that feature in predictions and bar graphs. While it might appear flippant to be comparing events of such magnitude in terms of real estate trends, we must question the ground reality here.

Political Factors

Political factors have a direct effect on the growth of the real estate market. The effect of political factors on real estate depends on the state of the nation’s economy at the time. Remember, real estate growth coincides with economic factors which are in turn affected by political factors. How do political factors play into the real estate picture? The state of the economy is often the result of strong or weak political leadership and this makes a vast difference. There may be a weak economy with high unemployment and prices, but if the loan interest rates are low, the real estate market will not suffer, and thus, it will be a sound investment for investors. It is rare that real estate growth slows because of the economic conditions within the rest of the economic sector, but it may experience less growth than it would if economy were strong and reliable on the whole.

Local Aftershocks

The effect of political factors on real estate can vary locally the same way that economy can differ between cities within a state. For example, if inflation rates rise, we see a trend that may have a detrimental effect on the real estate growth, especially with unemployment rates also simultaneously high. Even if interest rates remain low, the figure could increase and thus the real estate growth rate may decrease to accommodate higher interest rates. The real estate growth rate of rentals, however, will remain high, with tenants spending a large stake of their salaries on rent. Are these fueled by political factors? Time to sit back and think isn’t it?

New Beginnings

When elections draw near, other political factors may present themselves as the nation looks toward either change or stability i.e. choosing between the opposition or the current ruling party. What effect these political factors will have on real estate will often not be obvious for a year after polls close. In the meantime, we as realtors and brokers must follow the current affairs and keep a close watch on political factors that could determine the security of real estate investments and real estate growth. Currently the market is still strong, and there is no reason to think it will not continue to be strong. The market is not volatile like other economic and financial markets, so it tends to stay reasonably strong, even when if other markets lose ground.

Current Affairs

It is a known fact that the world real estate is the backbone of industry today even if it is the digital and virtual world of information technology. The future of the growth of any industry is directly or indirectly related to the real estate trends. One must as a professional realtor or broker stay attuned to international and national events and assess their impact on the market. We all were devastated by the effect of the tsunami on Japanese population from a humanitarian perspective, but as real estate professionals let us also dispassionately study the economical repercussion of such natural disasters in order to be able to better predict the constant changes in the global and local real estate markets.

This is imperative as destruction often heralds the creation of a new era and creation of new entities is the underlying force of real estate. In the light of the this, let us learn to be aware of and assess current affairs of both natural and political nature that are going to shape the industry directly or indirectly.

Tags:

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply