Retailers and Brands Must “Think Locally” to Expand Globally

If a company is successful here in the great big USA, it follows that it could be just as prosperous elsewhere. However, that is not always the case. Cultural differences can trip up even the biggest retailers, so it becomes imperative to know local lifestyle before embarking on international expansion.

When Target expanded its stores into Canada, the retailer discovered that Canadian shoppers differ from their American neighbors. Canadians, for example, are neither accustomed to doing all their shopping under one roof, nor big fans of couponing.

When companies hit a bump in their expansion, it can take a toll on the entire bottom line. In a white paper by Euromonitor International titled, “The Internationalisation of Retailing — Success, Failure and the Importance of Adapting to the Market,” it was determined consumers around the world are radically different, “so it is illogical to assume they all want to purchase exactly the same thing in exactly the same way.”

Understanding local markets is crucial to fashion retail. Deloitte LLP’s “Global Powers of Retailing 2014″ study reveals how fashion retailers adopt a more international profile than other product sectors. On average, they spanned 22.2 countries, more than twice the average for the Top 250 largest retailers around the world.

Expansion, while seemingly inevitable, should be controlled, according to Jeremy Grantham, co-founder of money management firm Grantham Mayo van Otterloo (GMO). His position is that rapid expansion in growing countries can actually hurt the bottom line since companies “often outrun the capital with which to grow and must raise more capital.” On the other hand, slow growth will allow for companies to learn about and understand local culture, a crucial factor in global market penetration.

Take, for instance, the Chinese consumer. CCI and Cotton Incorporated’s 2014 Global Lifestyle Monitor Survey finds that apparel shopping affinity and frequency are on the rise among Chinese consumers living in mega-cities like Beijing, Shanghai, and Guangzhou, which may be why China is projected to become the world’s largest apparel market by 2020, according to Euromonitor International.

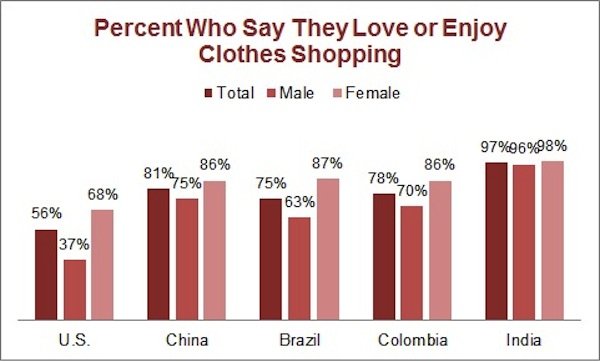

Currently, a full 81 percent of Chinese consumers living in mega-cities “love or enjoy clothes shopping,” compared to 54 percent of U.S. consumers, and 63 percent shop once a month or more for apparel, a figure that has doubled from a decade ago (31 percent). All these factors are very enticing to a retailer or brand that’s looking to grow.

According to the Euromonitor, the lack of suitable retail property has stifled growth in many emerging markets. The paper notes that, “unlike Western Europe, where high street shopping is dominant, malls are the preferred shopping venue in China’s major cities. Consequently, retailers… need to secure the few upmarket leases that emerge in markets such as China.”

While the Chinese fondness for department stores remains, the Global Lifestyle Monitor data shows the preference has declined to 35 percent from 40 percent in 2003. Their next favorite places to shop are the internet (31 percent, up from 0 percent in 2003), specialty stores (21 percent, down from 23 percent), independent stores (which decreased from 13 percent to 5 percent), off-price stores (4 percent, an increase from 1 percent in 2003) and chain stores (3 percent, flat since 2003). Online apparel sales are projected to quadruple in the next five years.

Monitor data also shows that the majority of Chinese shoppers living in mega-cities (69 percent) get their apparel ideas from the Internet. However, the Euromonitor says Chinese consumers have yet to embrace web shopping like other countries have. Therefore, retailers need to secure store locations. The Chinese preference for “the Internet” for clothing inspiration is followed by what they already own and like (55 percent), store displays (47 percent), friends and colleagues (46 percent) and magazines (35 percent), according to the Monitor survey.

The Euromonitor suggests that retailers should be mindful that average incomes in emerging markets — including China’s — are still a fraction of consumers’ incomes in the developed world. It indicates apparel retailers need to convince local consumers that their brands are superior to cheap alternatives.

Quality is important in apparel choices for most emerging countries including India (96 percent), Colombia (95 percent), Thailand (93 percent), China (92 percent), Turkey (92 percent) and Brazil (92 percent).

Deloitte’s study showed Latin American retailers outpaced other countries in consumer demand, with 14.7% composite retail revenue growth from 2007 to 2012. This was followed by Africa/Middle East at 13.5% and “Other” Asia/Pacific (not including Japan) at 8.7%. Japan lagged at 2.3%.

Brazil is the largest apparel market in Latin America, with apparel expenditures expected to grow by nearly one third by 2020. Colombia is projected to be one of the fastest growing apparel markets in Latin America, with apparel expenditures projected to grow 34 percent by 2020.

Roughly 3 in 4 Brazilians (75 percent) and Colombians (78 percent) say they love or enjoy clothes shopping, and clothes shopping frequency has increased in both countries over the past decade. Thirty-eight percent of Brazilians say they shop for clothing once per month or more, up from 30 percent in 2003. Forty-one percent of Colombians shop for clothes once per month or more, up from 27 percent in 2003.

But unlike in the U.S., where the majority of consumers shop at either mass (24 percent) or chain (24 percent) stores, almost half of Brazilians shop at chain retailers (49 percent), followed by independent (22 percent), specialty (13 percent), and department (3 percent) stores. Colombians also differ from their U.S. counterparts, but shopping mostly at specialty (31 percent), independent (29 percent), and department (17 percent) stores for apparel.

Meanwhile in India, fully 94 percent of consumers “love or enjoy clothes shopping,” according to Monitor data. Additionally, at a projected US $116.7 billion, India is expected to become the world’s third largest apparel market by 2020, according to Euromonitor International. While quality is one of the most important (96 percent) purchase drivers for Indian consumers, more than 6 in 10 say they are noticing fiber substitution away from cotton (71 percent), less durable clothing (65 percent), and thinner fabrics (63 percent) at retail.

Again, while the lure is strong, as the Euromonitor points out, “Internationalisation, while increasingly important, is not a straightforward task.”

by Catherine Salfino Via SJ

Connect With Us

Related Posts

- Real Estate Act comes into effect: 10 things you need to know about new law ( May 4, 2017 )

- Expats Living in Comfort – Hyderabad, India ( May 4, 2017 )

- MNC queue to Hyderabad grows longer; JP Morgan & IBM look for office space ( June 22, 2016 )

- An Apple in Hyderabad’s IT Garden: CEO Tim Cook’s big announcement Today ( May 19, 2016 )

- Hyderabad May get Disneyland Park ( April 22, 2016 )

- Indian Office Space Absorption Up 11% in Q4: Survey ( April 13, 2016 )

- Cognizant plans to add 8,000 people at Hyderabad facility ( March 9, 2016 )

- Ranked 139 in world, Hyderabad is Best Indian City to Live in ( February 24, 2016 )

- The Platina – Exclusive Commercial Space, Hyderabad ( February 19, 2016 )

- Apple, Inc set to open new $25 million Tech Center in Hyderabad, India by June ( February 16, 2016 )

Recent Posts

Recent Comments

Archives

- February 2018

- October 2017

- May 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- July 2011

- June 2011

- May 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- May 2010

- April 2010

- March 2010

- February 2010

Leave a reply